The rise and rise of ESG in the pharmaceutical sector - is a zero-waste supply chain possible?

ESG pledges are coming thick and fast in the pharmaceutical world – but are industry leaders in a position to deliver? Doing so will require a re-evaluation of the entire supply chain.

Sign up for the Controlant newsletter

Keep up with developments in pharma supply chain visibility. Sign up for Controlant Insights and receive our latest white paper.

Firms in the pharmaceutical industry – as with those in many advanced sectors – have become increasingly preoccupied with environmental, social and governance (ESG) goals in recent years. It is a trend that shows no signs of slowing down.

Household names are leading the way. AstraZeneca has announced its supply chain will be carbon negative by 2030. Pfizer, in addition to promising carbon neutrality by the same date via a 46% reduction in direct emissions and 100% renewable electricity purchasing, says its North American operations will be entirely solar powered by the end of 2023. Of the world’s 20 largest pharmaceutical companies, 17 have launched programmes tailored towards increasing medication access in low- and middle-income countries – up from just eight in 2010.

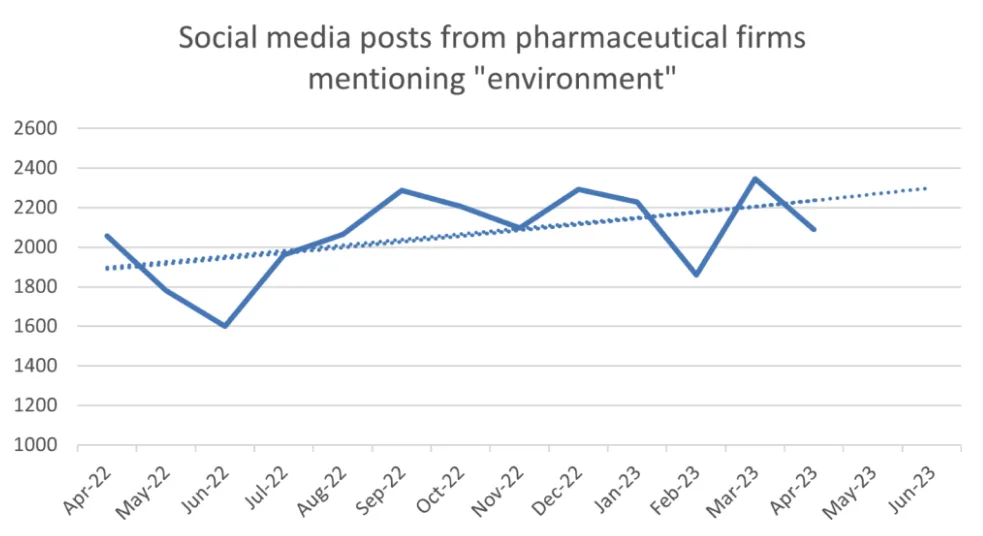

Figure 1: Social media posts from pharmaceutical firms mentioning “environment”. Source: GlobalData.

Measuring ESG sentiment

Excitement around ESG is growing right across the industry for firms of all sizes. GlobalData’s social media sentiment database reveals that, even over the past year, the trend towards discussion of environmental topics among pharmaceutical influencers has ramped up. It is projected to increase even further.

Meanwhile, GlobalData figures show that new job postings within pharma relating to social responsibility in the third quarter of 2022 grew by 10% quarter-on-quarter – and a whopping 161% year-on-year. A similar theme is evident in company filings. GlobalData analysis of 757 pharmaceutical company filings points to environmental sustainability references rising by 114% in the first quarter of 2023 compared with the last quarter of 2022.

The pharmaceutical industry is reshaping itself in a more environmentally and socially conscious image. Supply chains are increasingly in the spotlight. The onset of the Covid-19 pandemic was one catalyst; GlobalData social media analytics suggest supply chains received 1,908 mentions in 2019, compared with 25,636 in 2021. Since then, war in Ukraine, sanctions against Russia and the return of inflation in the developed world has made supply chain sustainability and security an even more pressing issue. Pharmaceutical industry decision makers are under more pressure than ever before to both deliver crucial medicines and minimize their impact on the planet.

Lofty rhetoric – lackluster results?

So far, the ESG era is eliciting an enthusiastic response. According to Pharmaceutical Technology analysis of climate commitments among major global corporations, the pharmaceutical and biotechnology sectors are ahead of the game; the 32 biggest companies have committed to reduce emissions by 45.8% over the next 12 years. That compares to 44.6% among similarly sized non-pharmaceutical firms over the same period. But the industry still has some way to go before it will shake its reputation for having a much higher (by more than 50%) GHG emissions intensity (Co2 per $revenue) than the automotive sector – a sector often criticized for its use of non-renewable resources.

In this context, the Science Based Targets initiative (SBTi) has provided a paradigm for change. Thousands of companies globally have undertaken SBTi commitments since the launch of the scheme, a collaboration between the Carbon Disclosure Project, the United Nations Global Compact, the World Resources Institute and the World Wide Fund for Nature. It lays out three different types of emissions scopes: scope 1 covers emissions from owned sources, scope 2 covers emissions from indirect sources like consumption of purchased energy and scope 3 covers all other emissions throughout the value chain – for example waste disposal, transportation, and warehousing. Firms’ scopes 1 and 2 targets tend to be more voluminous and more ambitious than scope 3 – but SBTi emphasizes that all are vital in the quest to limit temperature rises to within 1.5° Celsius by 2050.

Speed bumps on the road to SBTi action

However, the pharmaceutical industry faces a problem. Turning sector-wide enthusiasm around SBTi into concrete action takes time and money. And it is unclear whether either are in sufficient supply.

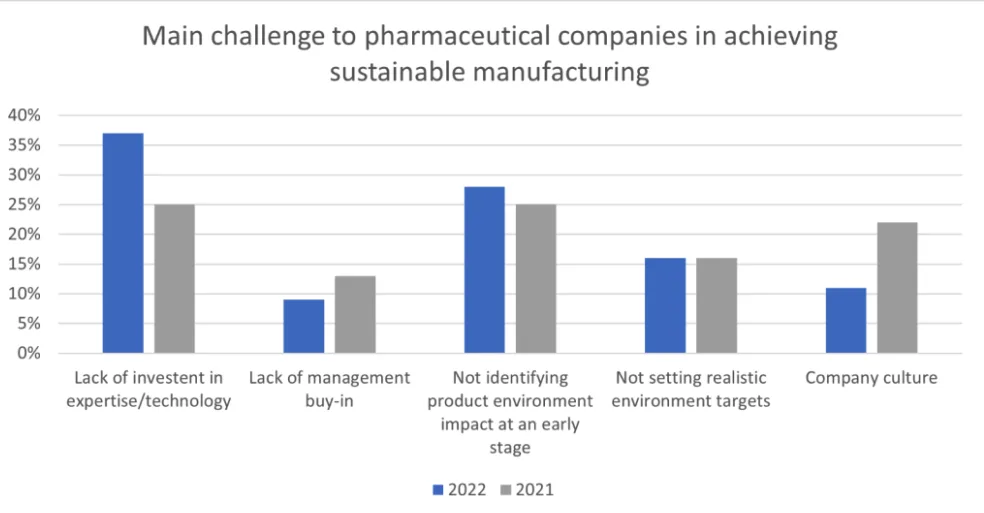

Figure 2: Main challenge to pharmaceutical firms in achieving sustainable manufacturing. Source: GlobalData.

Social media sentiment, company filings and job postings are all sounding notes of optimism around environmental targets – but those at the industry coalface have reservations. A GlobalData survey of 312 B2B business decision makers in the pharmaceutical sector suggests the gap between rhetoric and action is real and may be widening. Lack of management buy-in and apathetic company culture were listed as the main challenges in ramping up sustainable manufacturing by 13% and 22% of respondents respectively in 2021. Those figures dropped to 9% and 11% in 2022, suggesting decision makers are actively encouraging more sustainable practices and diffusing enthusiasm throughout their organizations. But lack of investment in the right expertise and technology was the main hurdle cited by 37% of respondents in 2022, a significant rise from 25% in 2021. This needs to move in the opposite direction – and fast – if the ambitions laid out by the SBTi are to be fulfilled.

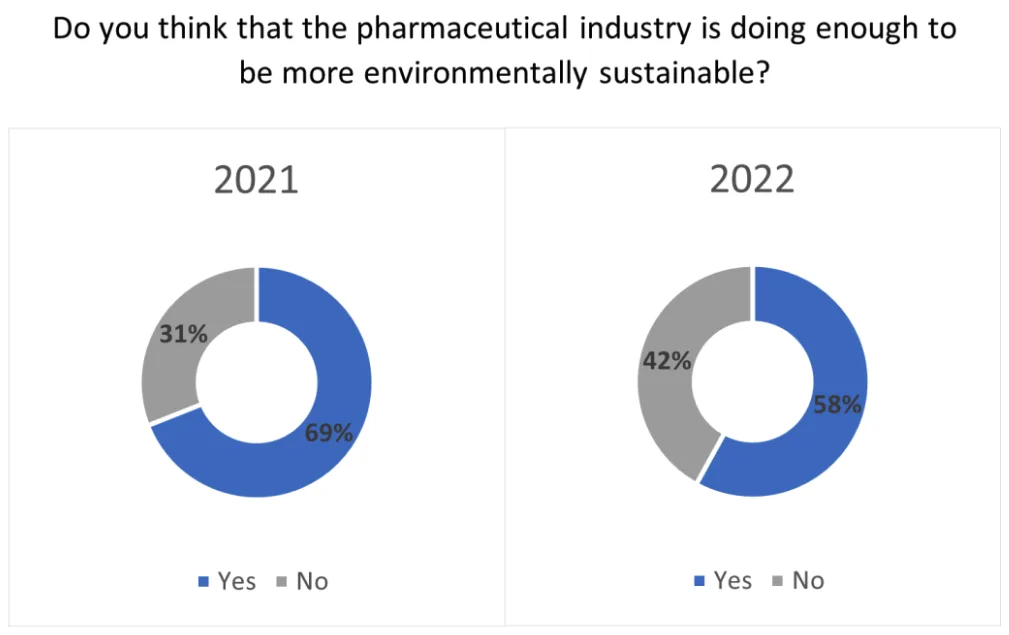

Figure 3: Do you think that the pharmaceutical industry is doing enough to be more environmentally sustainable? Survey of pharmaceutical industry business decision makers. Source: GlobalData.

Many think their organizations, and the wider sector, must do more. In 2021, 69% of survey respondents agreed the pharmaceutical industry was doing enough to promote environmental sustainability. That majority is shrinking: in 2022 58% of respondents said the same.

Restoring faith in the pharmaceutical sector’s ability to meet its SBTi undertakings requires decisive action. Operators need to root out where their emissions are coming from to accelerate their scope 1, 2 and 3 targets. Doing so will require a comprehensive re-evaluation of entire supply chains – something that can only be done with a level of visibility, interactivity, and control that has hitherto seemed elusive.

Supply chains and the fight against emissions

New SCM platforms are hitting the market which can make the lives of supply chain chiefs easier. Using data from reusable IoT devices, they allow shipments to be monitored live, remotely, and sustainably – all of which can bolster efficiency while reducing waste and environmental impact. Cracking down on waste in both pharmaceutical products and logistics means the platforms are aligning the firms that use them with the wider industry’s increasing emphasis on sustainability.

Practical steps

One example of a practical approach that firms can benefit from is the zero-touch release process. Automating product release and significantly reducing lead times lessens logistical demands and makes transportation more efficient – all of which adds up to a more sustainable supply chain. Controlant’s GxP-validated product stability automation release process stands out as a market-leading solution, simplifying and accelerating release processes while ensuring quality standards. Automation via the company’s Aurora Platform has already resulted in significant time reductions – a 95% drop in manual evaluations for release documentation and a 97% overall decrease in time from delivery to release recommendation.

Committing to sustainability leadership

Controlant became one of the first companies among its global industry peers to receive validation of a science-based target, throwing down the gauntlet for other tech companies and setting a high benchmark for reducing greenhouse gas emissions and waste in global pharma supply chains. Controlant joins its customers and partners on the journey towards decarbonization; its platform offers decision makers the bridge they need between rhetoric and action, putting power back in the hands of supply chain managers to get waste down, maximize sustainability, and follow through on their SBTi commitments.

The vast majority of the pharmaceutical sector agrees on the need to take a strong stance on meeting pressing ESG goals. Working out how to do it has been the issue. By working with partners like Controlant, industry trailblazers can adopt technologies that will give them oversight of their waste-creating, emissions-generating activities – offering a foundation for achieving the sustainable, zero-waste supply chains that have up to now been the stuff of lofty rhetoric.